New Delhi [India], September 5 (ANI): The revenue loss of the central government due to the recent GST rate reduction will be around Rs 3,700 crore in FY26, as higher growth and a boost in consumption have reduced the impact on revenues, according to a report by the State Bank of India (SBI).

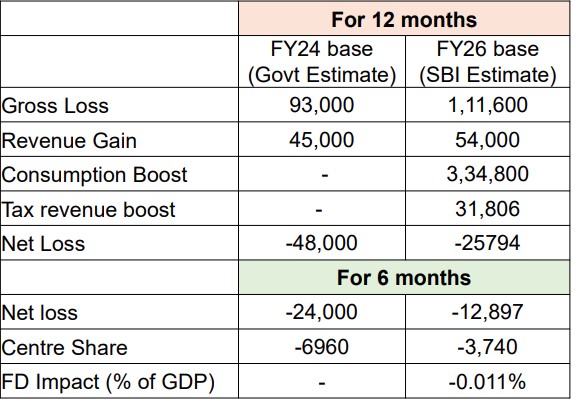

The report highlighted the data that by taking the baseline of FY24, the government had estimated a gross loss of Rs 93,000 crore due to GST rate cuts.

However, after adjusting for extra revenue collection, the net loss stood at Rs 48,000 crore.

For FY26, SBI estimates the gross revenue loss to be higher at Rs 1.11 lakh crore. But with strong consumption trends and higher tax revenue, the net loss is projected to decline sharply to Rs 25,794 crore for the full FY26 including centre and states share.

For a six-month period, the Centre’s share of loss is significantly smaller.

As per FY24 baseline, it stood at Rs 6,960 crore, while in FY26 it is expected to reduce further to Rs 3,740 crore.

It stated “based on the trend growth and consumption boost, we expect Rs 3,700 crore revenue loss in GST”

On an annualized basis, the government estimates the net fiscal impact of GST rationalisation at around Rs 48,000 crore. However, SBI’s calculations, based on trend growth and consumption boost, point to a much smaller revenue loss of Rs 3,700 crore, which is just about 1 basis point impact on the fiscal deficit.

The report also pointed out that in the past, GST rate cuts have led to additional revenues of nearly Rs 1 trillion.

It emphasized that rationalisation of tax rates should not be seen as a temporary stimulus to demand but rather as a structural reform. The simplified framework is expected to reduce compliance burdens, encourage voluntary compliance, and widen the tax base in the long run.

On the inflation front, the report mentioned that the reduction in GST rates on essential items, around 295 in total, has brought down rates from 12 per cent to 5 per cent or NIL.

This is expected to reduce CPI inflation in this category by 25-30 basis points in FY26, considering a 60 per cent pass-through effect on food items.

Additionally, the rationalisation of GST rates on services is estimated to lower CPI inflation by another 40-45 basis points, with a 50 per cent pass-through effect on other goods and services.

Overall, SBI expects CPI inflation to moderate by 65-75 basis points over FY26-27, providing further relief to consumers while ensuring minimal impact on government finances. (ANI)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages